GSTR-9 Filing – GST Annual Return

GSTR-9 or GST Annual Return must be filed by all regular taxpayers registered under GST having a revenue of over Rs.2 crores. The only category of GST registered entities not required to file GSTR-9 filing are input service distributors, casual taxable persons and non-resident taxable persons. The due date for filing GSTR-9 for FY2017-18 is 30th November, 2019. In this article, we look at GSTR-9 filing in detail.

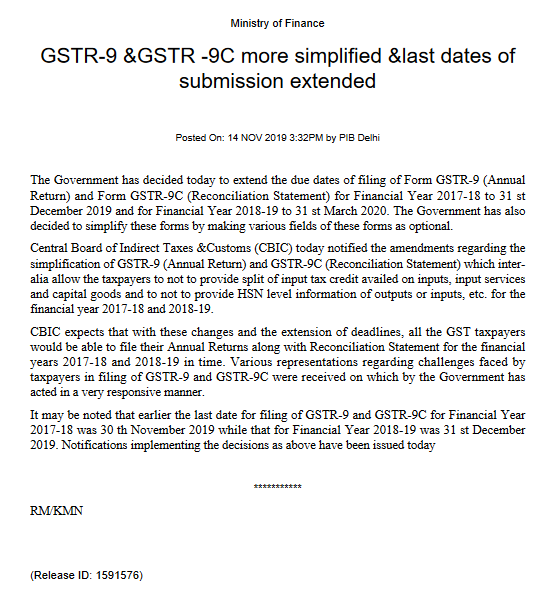

Due Date Extension

As per the latest notification from the Ministry of Finance, the due date of filing GSTR-9 is extended upto 31st December 2019 for the FY 2017-18 and upto 31st March 2020 for the FY 2018-19. Please find the notification below:

What is GSTR-9 Filing?

GSTR-9 or GST annual return is a type of GST return that must be filed by regular taxpayers and persons registered under GST composition scheme. GSTR-9 must be filed each year through the GST Common Portal or LEDGERS GST Sofware or at a GST Facilitation Centre.

Who should file GSTR-9A return?

Regular GST taxpayers filing GSTR-1, GSTR-2 and GSTR-3 must file GSTR-9A, consolidating information furnished during the previous financial year.

Who should file GSTR-9B return?

GSTR-9B return should be filed by electronic commerce operators who are required to collect tax at source. In addition to GSTR-9B return, electronic commerce operators will also be required to file GSTR-8 return, every month.

Who should file GSTR-9C return?

Regular taxpayers registered under GST having an annual aggregate turnover of over Rs.2 crores during a financial year are required to get their accounts audited and file a copy of the audited annual account and reconciliation statement along with GSTR-9C return. The GST annual audit can be done by a practising Chartered Accountant or Cost Accountant.

What information should be filed in GSTR-9 return?

The following information is expected to be filed in GSTR-9A return:

- Total value of purchases on which ITC availed (inter-State)

- Total value of purchases on which ITC availed (intra-State)

- Total value of purchases on which ITC availed (Imports)

- Other Purchases on which no ITC availed

- Sales Returns

- Other Expenditure (Expenditure other than purchases)

- Total value of supplies on which GST paid (inter-State Supplies)

- Total value of supplies on which GST Paid (intra-State Supplies)

- Total value of supplies on which GST Paid (Exports)

- Total value of supplies on which no GST Paid (Exports)

- Value of Other Supplies on which no GST paid

- Purchase Returns

- Other Income (Income other than from supplies)

- Return reconciliation Statement

- Arrears (Audit/Assessment etc.)

- Refunds

- Turnover Details

- Profit as Per the Profit and Loss Statemen

- Gross Profit

- Profit after Tax

- Net Profit

- Details of Statutory Audit

What is the penalty for late filing of GSTR-9 return?

A per day penalty of Rs.100, up to a maximum amount of Rs.5000 would be applicable for late filing of GSTR-9 return. Only if all the GSTR-1, GSTR-2 and GSTR-3 returns are filed, the taxpayer would be able to file GSTR-9 return on the GST Portal.

Should GSTR-9 return be audited?

Yes. Regular taxpayers registered under GST having an annual aggregate turnover of over Rs.5 crores during a financial year are required to the GSTR-9 return with audited accounts. GSTR-9 accounts can be audited by a practising Chartered Accountant or Cost Accountant.