IE Code Application

More and more SMEs are becoming global in terms of doing business due to the growth in e-commerce platforms, cloud computing technology and strong logistics network. Today, a business in the India is easily able to sell its goods to a customer in USA through e-commerce platforms like Amazon or Alibaba. In this scenario, having an import export code (IE Code) becomes critical in terms of doing business. Any business in India that imports or exports goods and/or services would require an IE code. In this article, we look at the procedure for making an IE Code application in detail.

To obtain IE Code for your business, get in touch with an IndiaFiling Advisor.

Import Export Code (IE Code)

Import & Export Code is to be obtained by the business entity for import into or export from India. Import & Export Code is popularly known as IEC number. Import & Export Code is issued by Directorate General of Foreign Trade (DGFT). IEC is a 10 digit unique number. IEC registration certificate is mandatory for business who are involved into import and export. Hence, before initiating an import of goods into India, an importer must ensure that the importing entity has GST registration and IE code – both of which are required to clear customs.

If an importer does not have both IE code and GST Registration, the goods will be stuck at the port and will start incurring demurrage charges or could be destroyed.

Validity of IE Code

IE Code registration is permanent registration which is valid for life time. Hence, there will be no hassles for updating, filing and renewal the IEC registration. It is valid till the business exists or the registration is not revoked or surrendered. Further, unlike tax registrations like GST registration or PF registration, the importer or exporter does not require to file any filings or follow any other compliance requirement like annual filing.

As IE code registration is one-time and require no additional compliance, it is recommended for all companies and LLPs to obtain IE code after incorporation.

IE Code Not Required

An IE Code is required for import of any type of goods by a business. However, the following are category of persons are exempted from obtaining an IE Code:

- Importer and export by central government or agencies or undertakings for defense purpose or other specified list under Foreign Trade (exemption from application of rules in certain cases) Order, 1993.

- Import or Export of Goods for personal use.

Documents Required for IE Code Application

The following are the documents required for making an IE Code application in India.

| Proprietorship |

|

| Partnership firm |

|

| LLP or Private Limited Company or Section 8 Company |

|

| Society or Trust |

|

| HUF |

|

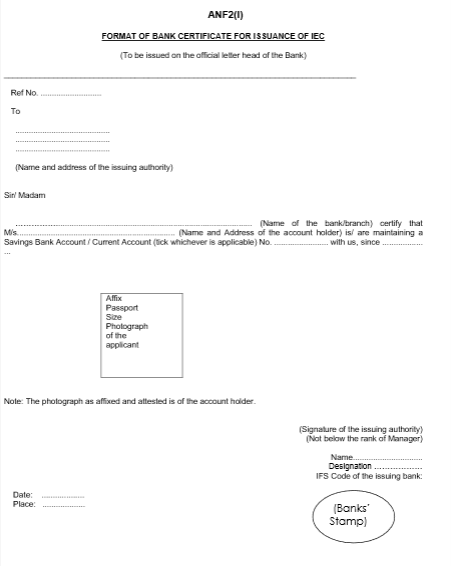

In case the applicant cannot provide cancelled cheque copy with preprinted names, the following bank letter format would have to be obtained from the Banker:

IE Code Application Procedure

Once, all the above documents is available, the applicant can initiate the IE code application process on the DGFT website:

- Step 1: Enter your PAN on login page and mention your valid Email and Mobile number.

- Step 2: Complete the application and upload the documents required.

- Step 3: Proceed for online payment and attach digital signature.

A sample IE code application is reproduced below with details that would be required to make an IE code application:

On submission of application, IE code is usually issued with 5-7 working days if no discrepancy is found in the IE code application.